Business owners have a lot on their plates, especially when it comes to finances. Like anyone else, business owners are concerned with their own savings strategies, debt obligations, and protecting their loved ones financially. But they also have to think about the cash flow needs of their business, business income cycles, succession planning, and the viability of the business if something were to happen to them.

Business and Personal Financial Planning Together

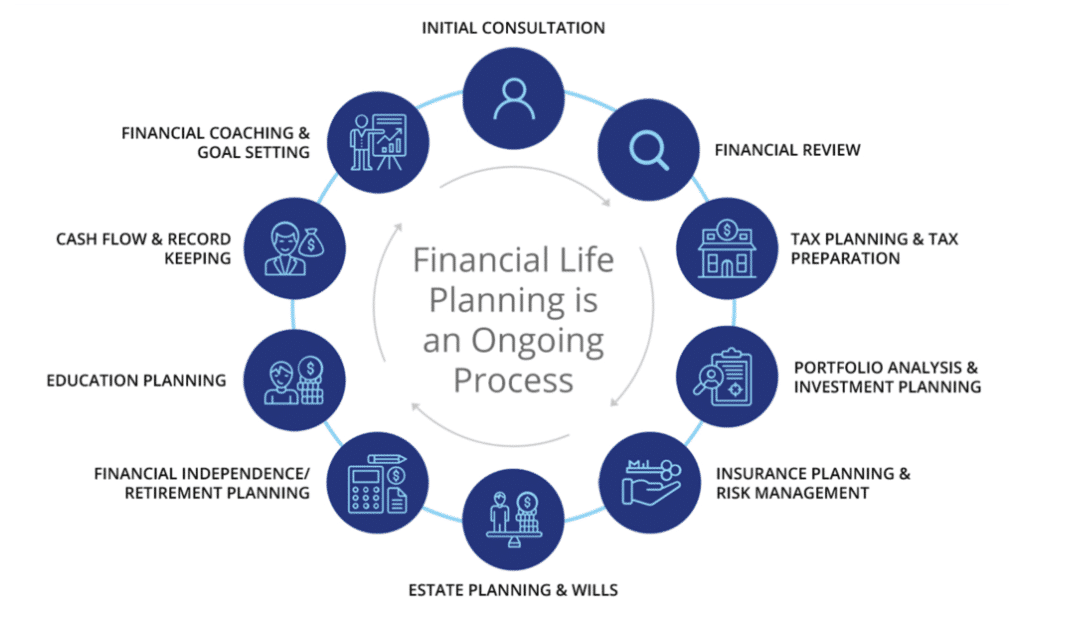

Because you’re actively running your business, we help you organize your finances and plan for the future, both in terms of your personal life and for the needs of your business. In addition to holding the CFP® and CPA designations, our founder also has an MBA, so we have a unique understanding of business owners’ financial needs. We work with business owners to:

-

- Maintain a personal, consistent income stream

- Create a retirement plan for you and your family

- Strategize how your family will continue to receive income from the business if something unexpected happens to you.

- Minimize your personal and business tax burdens

- Develop a succession plan and exit strategy from your business when you’re ready to retire

- Ease complicated financial concerns

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.