Most physicians spend an extraordinary amount of time working, leaving them little time to think about their finances. But physicians face unique challenges when it comes to financial planning. As high earners, physicians have to save more for retirement to maintain the lifestyle they’re used to. Physicians also carry high student loan balances, which can complicate the need to save more for retirement.

Personalized Financial Planning for Doctors

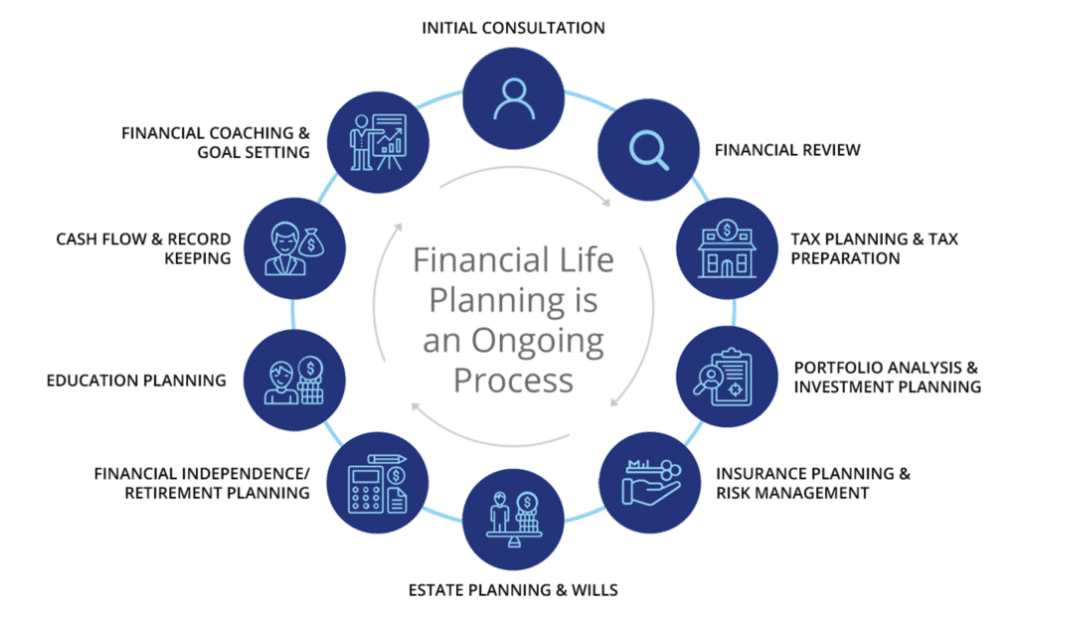

Because you’re busy caring for patients who trust you, we work to help you plan for all areas of your financial life in one streamlined process that addresses your unique financial needs. Just as you wouldn’t write out a prescription or recommend a course of treatment before making a diagnosis, we don’t view our clients’ lives in a one-size-fits-all context.

We never make a recommendation without a diagnosis, nor do we invest your money without an intimate understanding of your financial history and concerns. And just as the patient wants to understand her doctor’s diagnosis and treatment plan, we stress education so you can participate fully in making the decisions that will help you reach financial independence. We work with physicians to:

- Balance student loan repayments with contributions to your retirement account

- Develop a comprehensive retirement plan that maximizes the advantages of tax-deferred accounts and other wealth accumulation strategies

- Evaluate and minimize your tax burden

- Ease complicated financial concerns

- Develop a succession plan and exit strategy to leave your practice when you’re ready to retire