No Sales.

No Kickbacks.

No Commissions.

No Hourly Charges.

Just One Transparent Fee.

It’s tough to determine what most so-called “financial advisors” charge. Between commissions, hidden fees, and asset under management charges, you may end up paying a fortune and not even realizing it.

Shore Financial Planning is committed to complete financial transparency. You’ll make preset quarterly payments based on your specific financial needs and their complexity. That’s it – always.

The Transparent Cost of Fee Only Financial Advisors

What services will I get for my fee?

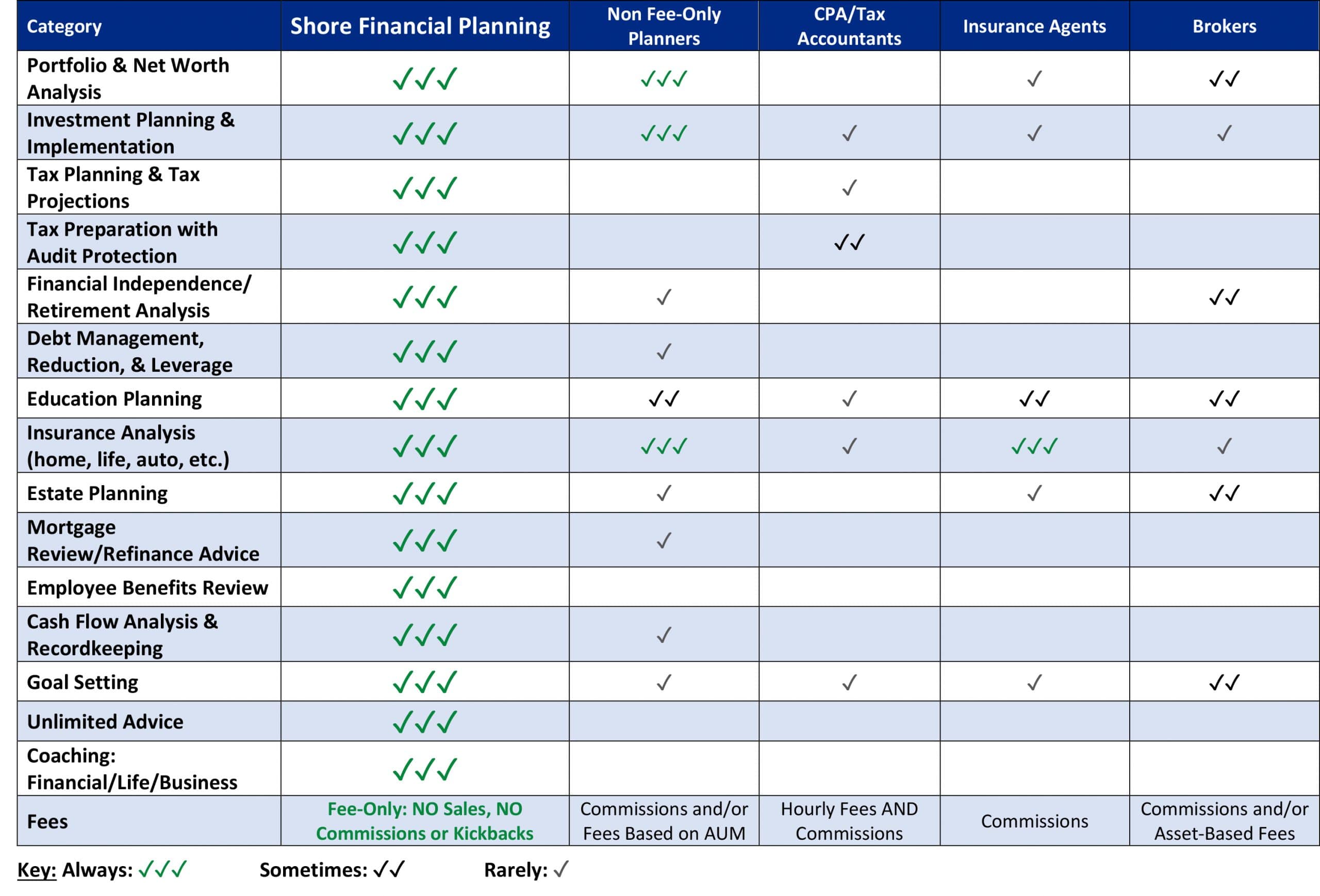

Our partners have the expertise to help manage and optimize all aspects of your financial life. See how we stack up against other “financial advisors”:

Do I really need a financial advisor?

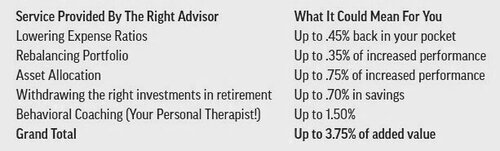

While we admire the independent thinkers and the DIY-ers, research from Vanguard demonstrates the potential value of working with the right advisor:

If you take $100,000 and earn 3.75% you get a future value of $208,815. That’s an extra $108,815 for every $100,000 invested! While difficult to quantify the exact value we’ll bring you, it’s proven that having the right advisor matters.