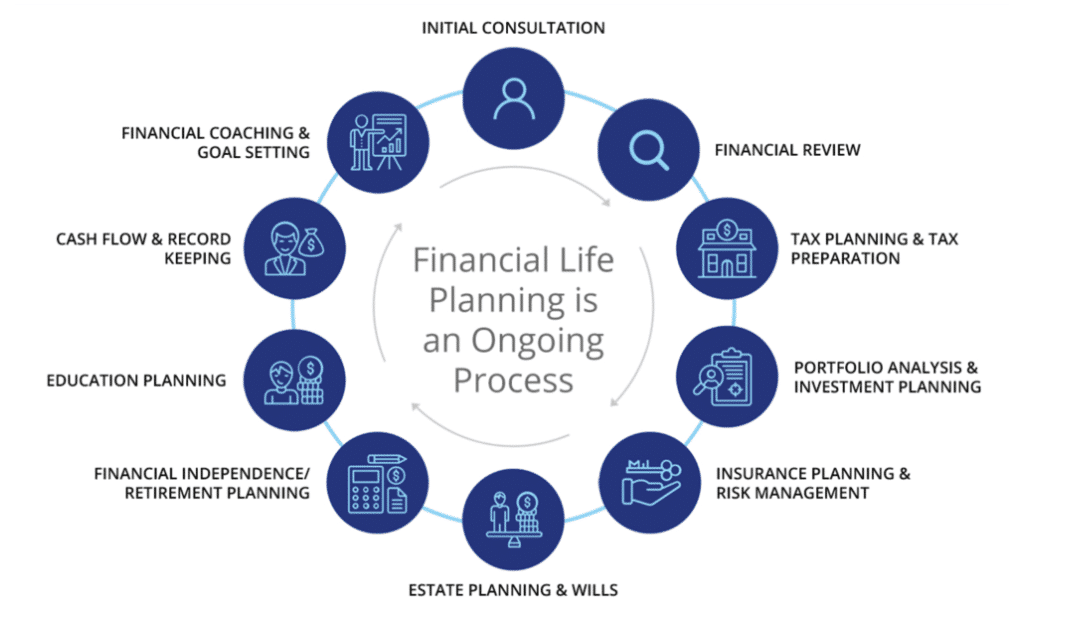

Comprehensive financial planning is important to establish financial security and prepare for future expenses like purchasing a home, paying for children’s college education, creating a legacy plan that protects your dependents, and, of course, saving for an enjoyable retirement that lasts your lifetime.

Financial Planning for All Stages of Life

No matter what stage of life you’re in, we help individuals and families with all their financial and tax planning needs to achieve financial independence. We work with individuals and families to:

-

- Develop repayment plans for student loans and other debt

- Save for big purchases like your first home

- Begin saving for your children’s college education

- Create tax strategies to minimize your tax burden

- Develop a comprehensive retirement plan

- Develop an estate plan to protect your loved ones

- Optimize Social Security strategies

- Ease complicated financial concerns